Unity S-1

Surprising figures.. and future of Tabletop Games!

Welcome to new subscribers who have joined since mid-August! If you are reading this but haven't subscribed yet, join my newsletter by subscribing here:

Hi friends 👋🏻,

Happy Friday, today's issue is a bit different than the usual ones with a longer piece dissecting Unity's S-1 filed earlier last week. This is the first time that a game engine company has filed for an IPO filing and the document has lots of interesting numbers. Let's dive in.

Unity is not an ordinary technology company, it is the world's leading platform for creating and operating other real-time 3D content. Unity has built its reputation in gaming but now also wants to grow outside of gaming. They have raised over $1.3B from investors through VC and secondary market sales. The biggest stockholders are Sequoia Capital, Silverlake Partners and JA Technologies owning 50.5 % of the company.

Some impressive numbers:

1.5M monthly active creators

3B downloads per month in 2019.

Although distribution isn’t yet in their hands, the vast majority of game developers use Unity as their preferred game engine.

Assuming that last year alone, there were ~40B downloads across AppStore and Google Play, Unity is the clear market leader in mobile gaming.

50%+ of all games built with Unity

60 out of 716 customers contributing >$100K yearly are outside of gaming.

Rapid revenue growth for a 14-year-old company: +42% YoY growth ($380M to $541M)

Unity generates revenue through Create Solutions (Monthly subscription) and Operate Solutions (Revenue share and usage-based monetization):

Create Solutions

Used to create, edit, run and deploy real-time 2D, as well as high definition, real-time 3D content. Our platform includes custom scripting tools and a high-definition render pipeline for developers; graphics, animation and audio tools for artists; and navigation, networking and user interface tools for designers.

Unity's entry point is Create Solutions where they offer tiered subscription plans for different types of customers: Pro, Enterprise, Plus, Personal and Student. They also provide ArtEngine to create ultra-realistic worlds using AI-assisted artistry (through Aromatrix acquisition, Granite to create virtual textures and Unity MARS for AR development.

Unity’s Create Solutions are primarily gaming first but they have started expanding to other industries such as architecture, manufacturing and engineering, cinematic entertainment and automative. Here’s a video of How Daimler used mobile mixed realities for production and sales and an image from a presentation made with Honda visualizing Urban EV using Honda’s custom editor:

Unity wants to capture market share in additional markets by providing industry-specific solutions.

Operate Solutions

Unity's Operate Solutions offer customers the ability to grow and engage their user bases, and to run and monetize their content irrespective of whether the content was created in Unity.

Monetization products: Unity Ads and Unity IAP (In-App-Purchases) help developers to maximize the revenue potential of their content. Launched in 2014 after Applifier and Playnomics acquisitions in 2014, added Unified Auction in 2017 to provide access to more advertising partners and DSPs.

End-user engagement products, such as deltaDNA, provide developers with the capability to perform deep analytics to optimize end-user engagement and behavior. Most of the revenue is generated based on the number of active users in the apps.

Solutions to simplify the delivery of content and provide back-end management, such as Multiplay for multiplayer hosting in games, or Vivox to enable player-to-player communications in games.

Especially, over the past 6 years, Unity made lots of investments through acquisitions and partnerships to expand its platform.

An interesting number from the document: 56% (!) of their total headcount works in research and development related activities to build their platform. Looking at their website, you can also find a long list of publications they made in Graphics, AI and performance. On the other hand, Unity is investing heavily in their machine learning products, such as GameTune, GameSimulation and Machine Learning Agents. The applications of these smart products will definitely go beyond gaming. For example, by combining autonomous driving and generating synthetic data, Unity might become the ultimate platform with built-in components.

Although it's still a nascent market, according to an interview with Former Head of Strategy APAC at Unity Technologies, looking at the AR/VR content: Unity's market share goes up to 80%-90%. They already started investing in advertising in VR.

Unity’s financials are very surprising and interesting. Although Unity is mostly known for its content creation tool (Create Solutions) and the game engine, a larger portion of its revenue comes from Operate Solutions (Monetization, end-user engagement and content management products).

Create Solutions drive Operate Solutions revenue: As they onboard more and more developers using their platform, more developers start using operate solutions.

I believe that majority of Operate Solutions’ revenue comes from Unity Ads given how widely known their ad network is used. Changes to Apple's privacy features with iOS14 (now delayed to 2021) will have a significant impact on Unity's ad revenues. As Facebook also announced last week:

We know this may severely impact publishers' ability to monetize through Audience Network on iOS 14 and may render Audience Network so ineffective that it may not make sense to offer it on iOS 14 in the future.

They have also seen a drop of more than 50% in Audience Network publisher revenue when personalization (based on IDFA) was removed from mobile app ad install campaigns.

Customers generating over $100K are increasing rapidly:

As of December 31, 2019, 48, or 8%, of our 600 customers contributing more than $100,000 in trailing 12-month revenue were in industries beyond gaming. As of June 30, 2020, we had more than 750 customers in industries beyond gaming, and 60, or 8%, of our 716 customers contributing more than $100,000 in trailing 12-month revenue were in industries beyond gaming.

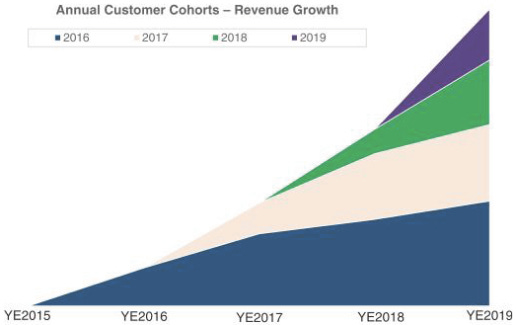

Unity has a very successful historical customer expansion over the past four years. Trailing 12-month revenue contribution from this cohort increased from $21.4 million as of December 31, 2018 to $57.0 million as of December 31, 2019, representing an expansion of 266%.

Unity’s revenue grew 42% YoY ($380M to $541M), although they are still losing money ($163M last year and $131M in 2018). Unity sees further growth opportunities in the combination of (gaming & non-gaming industries), and (new & existing customers)

For Operate solutions, Unity might continue acquiring companies to strengthen their portfolio beyond mobile advertising. They have also recently launched Unity Distribution Portal which helps developers publish their games beyond App Store and Google Play.

Although profitability is far along the way, Unity will continue to dominate the game industry by increasing its footprint by providing backbone technologies and also use their technology to be the dominating market leader in today’s nascent markets such as AR / VR and other non-gaming industries. It looks like it’s an exciting time to be at Unity, congratulations to everyone involved!

Sources used and other good reads:

Deconstructing Unity by Tim Smith

Unity: Analysing the First Game Engine IPO by Master The Meta

Unity Software: A Company Of The Future That You Can Own Today

🍿Good Content

The Digital Future of Tabletop Games by a16z ⭐️⭐️⭐️⭐️⭐️

Traditional tabletop games are being dramatically improved—and reinvented—by modern digital tools that provide innovative new playing experiences. Obtuse rulebooks can be overcome through livestreaming. User-generated digital content can provide endless replayability. Audio products create sustained engagement loops, despite infrequent play sessions. And a fragmented user base can be aggregated into online communities with strong network effects. The net result is that tabletop games are reaching larger audiences than ever before.

As tabletop games and video games collide, it becomes increasingly likely that the next big innovation in social play will be a merger of the two. With classic games like D&D, Warhammer, and Magic all reaching unprecedented levels of digitally-propelled success, the question is not if, but when and how.

📈 Investment news

Potato Play secures $1.75 million in seed funding for Asian hybrid-casual games

AT&T to Scrap Sale of Warner Bros. Video-Game Unit

Dorian raises $3.25M for its no-code, interactive storytelling platform

Competitive mobile game maker Skillz will do a quick IPO at $3.5 billion valuation

Mobile games app provider Huuuge Inc. confirms Warsaw IPO plans

Gameboard looks dope!

Thanks for reading and enjoy the weekend,

Emre

Written by Emre Colakoglu, an experienced product manager and analytics professional working in gaming based in London. You can find me on Twitter, my website and LinkedIn.